In the coming decade, climate changes will compel the creation of new ecological norms and rules for our economy. The financial industry will be at the center of this transition, determining which companies and technologies are granted the resources they need to spearhead this evolution.

So far, objectively evaluating the ethics and environmental impact of individual businesses has proved challenging. Many currently used metrics make it easy for companies to promote a message of ecological responsibility while continuing unsustainable practices, a discordance sometimes referred to as greenwashing. A movement toward measuring corporate sustainability based on quantitative values, open source practices, and open science can potentially circumvent this threat to economic transformation.

The limits of Environmental, Social, and Governance (ESG) investing

In recent years there has been a systematic shift toward evaluating companies on not only monetary but also ethical and environmental criteria. These nonfinancial factors are often referred to as Environmental, Social, and Governance (ESG) investing. Today about 40% of total assets worldwide under management are sustainable investments rated by ESG scores. The high demand for such financial products drives massive growth, with a predicted market share of over 95% by 2030. The following graph illustrates the growth in this sector.

Despite this promising development, greenhouse gas emissions like carbon dioxide are still accelerating. Climate stability and biodiversity risk being lost before the end of this century. Why is the trend toward sustainable investment not reflected in a similar change in physically measurable environmental variables?

Given the sheer volume of sustainable investments, it should come as no surprise that businesses worldwide are trying to represent their existing business models as green and sustainable in terms of ESG ratings. Without a positive evaluation, these companies could lose a large part of their future investment. As a result, greenwashing has considerably increased in recent years.

Open science creates reproducible knowledge

Since environmental impact is an empirical topic, businesses should be looking in the direction of science instead. Scientific evaluation has faced similar challenges in the past. The complexity of scientific experiments has led to the so-called replication crisis. New tools such as neural networks and other complex data processing chains have made scientific results difficult for other scientists to replicate. In addition, published papers provided insufficient information about their underlying data, instruments, and methods.

In the field of climate science and many other scientific fields, there has therefore been a rapid transformation. The triumph of open science, open access, open data, and open source can no longer be denied. Satellite data, climate models, software tools, and the associated programming languages are now open and freely available. Instead of arguing about the results of nontransparent studies, it is now possible to discuss scientific details of how results were obtained. As long as this is done according to open principles, these discussions remain scientific, objective, and evidence-based. Today, there are no studies based on open principles that can disprove the existence of climate change.

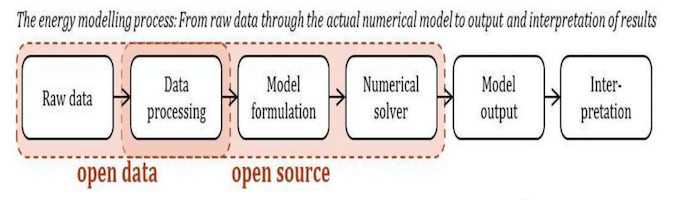

Open science and scientific discourse create reproducible knowledge. Open science communities like Pangeo represent prime examples of this field and show how these principles have transformed Earth science. Emerging platforms like Papers with Code or the Journal of Open Source Software have created a new mindset on how knowledge can be published and reviewed publicly. There is a strong trend toward open knowledge modeling within the energy modeling community, a backbone of the energy transition. Whether and to what extent purely renewable energies can cover our energy supply can therefore be discussed transparently, in detail, and scientifically by scientific communities such as openmod to find a common consensus.

Tobias Augspurger, CC BY-SA 4.0

Potential for an open source framework

Unfortunately, this mindset is not often found in ESG and sustainable investment. This becomes clear when looking at active open source projects in this domain. According to the website Open Sustainable Technology, there are only 10 active open source projects in the area of sustainable investment. Even strong projects like SBTi Temperature Alignment tool, OS-Climate, or r2dii.analysis are very small compared to other open source projects. As part of OS Climate, several companies, including Amazon, Red Hat, Airbus, Goldmann Sachs, and Microsoft, have joined together within the Linux Foundation to develop an open framework for climate-related investments. However, a glance at the repositories reveals that the project is still far from a practical application even after two years.

Although open source is known to provide solid and global standardization for the processing of data, there is only one attempt to standardize the ESG scoring method itself. Cary Krosinsky and the team of Real Impact Tracker released their methodology on GitHub with a blog post giving more background information. Nicolaas Koster, Matthias Memminger, and Stefan Woerner published similar articles about the high potential of an open source ESG framework and methodology.

Despite all these efforts, no professional open source rating ESG framework exists today. ElectricityMap is one of the very few commercial open source platforms with a community and a technical solution appropriate to solve problems related to business impact on climate change. But even CEO Olivier Corradi admits that automation and precision are less in demand than one might think when it comes to corporate carbon footprints.

Openness as a key indicator for sustainability

Nevertheless, the problems within sustainable investment clearly show that transparent and repeatable ESG scoring results are in demand. A company that makes it possible to disclose its sustainability on the basis of open science has an unbeatable, unique selling point in the battle for green investments.

In the rating of companies, openness can become a criterion in itself, making clear to what extent data and models behind the ESG reports of a company are disclosed. This allows the uncertainties and associated error bars to be calculated over sustainability statements. It enables the development of an independent scientific community concerned with corporate sustainability. Openness about one's sustainability would demonstrate the will to transform even in those companies that have not yet made much progress in this area.

Unfortunately, recent developments have shown that decisions about the sustainability of industrial sectors and technology are not subject to transparent scientific evaluation. Opaque political decision-making processes strongly influence decisions in this area. A study based on open science principles could provide a transparent and objective answer to the question of whether gas or nuclear power plants have a positive impact on the environment. It would also allow us to talk about risks and potentials if these technologies were used worldwide on a larger scale.

Conclusion

The open source and open science movements have changed the way digital product development and science collaborate today. Yet there is not a single company in the world that transparently discloses its impact on the environment through open science. Such a development, however, is the only way to verify the multitude of climate pledges made by companies. The question is how to incentivize companies to enable open science to measure their environmental sustainability. Measuring the openness of ESG reports and their underlying data and models is a realistic option.

Comments are closed.